If you own a Jacksonville rental property, you know the moment: the renewal notice hits your inbox and the premium is higher again.

Last year, the insurance company wanted roof photos and permits; this year, it is a higher deductible, tighter terms, and rising insurance premiums that punch straight through your cash flow.

These landlord insurance costs do not pause during vacancies or slow leasing seasons, and a single covered event. wind, water, or a surprise liability claim, can turn a “good year” into a scramble to repair and replenish reserves.

The good news is you are not powerless. With the right coverage choices and smarter risk control, you can protect margins and regain predictability.

Key Takeaways

- Start early and shop with many insurers so you can compare terms before deadlines tighten.

- Know the key differences between a homeowner's policy and a landlord's policy before you rent out the property.

- Use mitigation and maintenance to ensure insurers offer discounts and you prevent claims that push future rates.

- Protect cash flow with rental income coverage so that a covered event does not result in lost rental income.

Why Premiums are Rising in Jacksonville

Florida regulators have indicated that property insurance rate increases are starting to level off, but premiums still feel high for many owners. Jacksonville faces strong storms and a real risk of flooding.

Hurricane Irma pushed the St. Johns River to record levels in parts of downtown, and that history signals a higher risk to insurers, especially in high-risk areas near rivers, creeks, and low-lying neighborhoods.

Landlord Insurance and Homeowners: Use the Right Policy

Landlord insurance and homeowners insurance are designed for different realities, and using the wrong one can leave gaps.

1) When a Standard Homeowners Policy Fits

A standard homeowners policy (or standard home insurance policy) is built for a primary residence you live in.

Once you have long-term tenants in place and the home becomes one of your long-term rentals, that policy may no longer align with how the property is used.

The same is true if you’re temporarily renting the same property as a furnished rental for a big sporting event: the risk profile changes.

2) What You Get When Buying Landlord Insurance

Landlord coverage typically protects the building itself and includes liability coverage to cover liability if a tenant, guest, or delivery person says they suffered bodily injury on the property. For example, from a loose handrail or a slippery walkway.

Many policies also help with defense legal fees tied to liability claims. You can add personal property coverage for items you own in the unit (appliances, tools, or furnishings).

Tenants’ personal belongings are typically protected by their own renters insurance, not your landlord's policy. In simple terms, your coverage is designed to protect the property and your landlord's risks, while renters' insurance helps tenants replace what they own if it is damaged or stolen.

Cost Levers: Reduce Premium Without Creating a Gap

Landlord insurance rates are not one-size-fits-all. They depend on your property type, past claims, your coverage choices, and the deductible amount you agree to pay out of pocket.

When comparing quotes, do not just look at the price; match coverage line by line to understand the actual cost of what you’re buying. Also, ask whether wind damage has a separate deductible, because that can change your true out-of-pocket exposure.

A higher deductible can lower your premium and help you save money, but only if you have reserves to cover it after a loss.

Finally, watch for extra cost add-ons (endorsements). Some are smart additional coverage, like water backup or equipment breakdown, when they fit the property. This is “insurance vs” wishful thinking: pay for protection you understand and can use.

Discounts and Mitigation that Move the Needle

Florida rules require insurers to give credits for proven hurricane and wind upgrades, so do not leave savings on the table. Keep clear photos, permits, and invoices for roof work and storm protection, then send them to your insurance provider so your policy reflects those improvements.

Close the Flood Gap and Protect Income

Do not assume flood damage is covered. Most standard policies exclude it, so even with rental property insurance, you should confirm whether flood is excluded and how your insurer defines a covered loss, especially the difference between flooding and wind-driven rain.

Next, protect your cash flow: review your rent-loss option to know when loss of rental income begins, how long it pays, and what paperwork you must provide. Keep leases, rent ledgers, and repair invoices organized so a claim is easier to prove.

Finally, ask up front who pays hotel costs if tenants must relocate after a covered loss, your policy, the tenant, or neither, so you are not surprised during an emergency.

Operations that Keep Claims Down

Premiums follow claims, so focus on preventing the issues that drive losses. Regular roof checks, clean gutters, and fast leak repairs help prevent property damage. Safe lighting, secure locks, and solid steps and handrails reduce injury complaints. Standard inspections across all rental units demonstrate to insurers that you are a lower risk.

FAQs

- Can I keep my homeowners' insurance policy when the home becomes a rental property?

No, once it is not your primary residence, a standard homeowners insurance policy may not provide the right coverage.

- Does landlord insurance cover a tenant’s personal property?

No, renters' insurance is for tenants’ personal belongings and personal property.

- How do I lower landlord insurance policy costs without underinsuring?

Keep dwelling coverage at replacement cost, match the same coverage limit and coverage level, and choose a higher deductible only if you can pay it.

- Is flood included in landlord insurance coverage?

Typically not; FEMA explains flood insurance is separate from homeowners' insurance and is a different insurance policy.

Premiums Are Rising: Your Protection Strategy Can Be Smarter

Rising homeowners' insurance cost is a Jacksonville reality, but your response can be systematic. Treat homeowners coverage and the cost of landlord insurance as different tools, match the policy to how the property is used, and manage deductibles, documentation, and mitigation like core operations.

Done well, you gain financial protection against natural disasters, tighter control over landlord insurance premiums, and fewer renewal surprises, whether you own one single-family home or a growing portfolio of property owners.

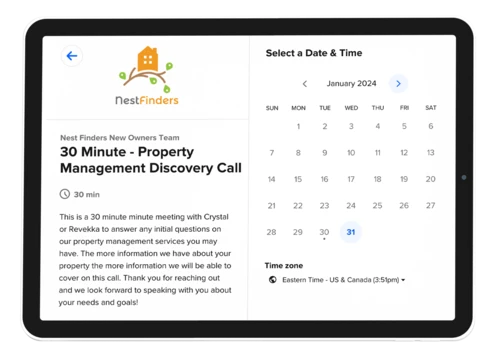

Nest Finders Property Management helps property owners standardize inspections, coordinate vendors, and maintain the records carriers, except for proper coverage. If you are weighing homeowners' insurance cost versus the cost of landlord insurance,

We can help you reduce friction, protect cash flow, and strengthen your renewal position. Call us today!

Additional Resources

Florida’s Live Local Act in Jacksonville: Zoning Preemption Explained for Small Landlords

How Much Can a Landlord Charge for Damages? Guide to Repair Costs and Legal Limits