It is 3:00 AM in Jacksonville. Your phone buzzes again. A Riverside tenant sends a shaky video as rain hammers the roof and a high tide pushes water under the door. By sunrise, the floors are slick, the breaker panel is a worry, and the only gear on site is a stack of beach towels.

The contractor says tomorrow, maybe. Rent is at risk, and a great tenant is packing. If this sounds familiar, you are not alone. San Marco, Avondale, and Ortega see it too when tides and cloudbursts meet.

The good news is you can plan for this. With the right upgrades, paperwork, and tenant playbook, floods become brief interruptions rather than long disasters. Here is how to stay ahead, protect cash flow, and keep units earning in 2026.

Key Takeaways

- Florida requires flood disclosure in residential leases of one year or longer, effective October 1, 2025.

- Citizens policyholders face phased flood requirements: higher-value homes are due on January 1, 2026, and the remaining homes are due on January 1, 2027.

- Risk Rating 2.0 prices each property based on its characteristics and can credit elevated equipment, flood openings, and a higher first-floor height.

- Wet floodproofing with damage-resistant materials is practical for many ground-floor spaces and enclosures.

- Your lease is a mitigation tool that pairs clear duties with appropriate insurance for owners and tenants.

Structural and Physical Mitigation

Elevate critical utilities. Floods hit low equipment first. Keep electrical panels, HVAC units, water heaters, and laundry machines above the expected flood level or protect them with sturdy platforms and enclosures. Moving panels and heaters a few feet higher can prevent weeks of downtime and thousands in repairs.

Choose materials that do not soak up water. On ground floors, swap paper-faced drywall for paperless gypsum or cement board. Use porcelain tile, sealed concrete, or rated luxury vinyl plank instead of carpet or laminate. Pick insulation and built-ins that tolerate brief contact with water and dry quickly.

Let water pressure equalize. In crawlspaces or enclosed foundations, add appropriately sized flood openings on multiple sides so water can flow in and out without pushing walls inward. Keep the screens clear and finish these areas with surfaces that can be washed and disinfected.

Design for wet floodproofing where it makes sense. Suppose a space may take on some water; plan for a fast recovery. Protect the structure, elevate or relocate equipment and valuables, and use finishes that dry within hours. Simple choices like raised outlets and elevated compressors add resilience.

Improve drainage around the building. Keep the soil gently sloped away from the foundation. Extend downspouts, clean gutters and yard drains, and fix low spots where water collects. Where allowed, use shallow swales or rain gardens to slow and redirect runoff.

Seal weak points. Tighten door thresholds, seal gaps around pipes and cables, use water-resistant trim, and keep a small flood kit on site with absorbent booms, mops, squeegees, and fans for rapid response.

Financial and Administrative Mitigation

Start with insurance that matches your property’s exposure. A DP-3 landlord policy doesn’t cover flood. For buildings, national flood policies typically insure up to $250,000 for the structure and up to $100,000 for contents.

Private flood insurers may offer higher limits and add-ons, such as loss-of-rent coverage. Shop both markets at each renewal, choose deductibles you can genuinely afford, and check waiting periods so coverage begins before the wet season.

Understand how Risk Rating 2.0 sets your premium. Pricing is based on factors such as first-floor height, distance to water, and foundation type. Upgrades that raise equipment, add compliant flood openings, or improve the first-floor elevation can reduce what you pay.

Elevation Certificates are optional now, but submitting one can help if it confirms a better elevation. Keep photos, invoices, and elevation data organized for your agent and underwriter.

Use your lease as a safety net. Require renters insurance for liability and non-flood losses, and clearly explain that standard renters policies do not cover flood losses. Encourage tenants to buy a separate contents-only flood policy for their belongings.

Include the Florida flood disclosure for leases of a year or more, and keep proof that you provided it. Spell out simple duties: move vehicles out of low spots, secure outdoor items, and report water intrusion immediately.

Keep an eye on maps and permits. Flood maps still matter for building rules and loans. Check current Duval County requirements before renovations, verify elevations, and plan for substantial improvement thresholds.

Communication Plan and Emergency Playbook

- Create a one-page Flood-Ready guide for each unit.

- Show the water shutoff, breaker panel, and high-ground parking.

- Explain when to move cars, secure outdoor items, and unplug electronics.

- List a 24/7 contact and simple if-then steps for watches, warnings, and evacuations.

- Send a refresher before the rainy season and store the guide in your portal.

- Use layered communications: portal posts, text alerts, and email.

- Time messages with local tide and weather alerts; king tides plus heavy rain often cause flooding near the river.

FAQ

My property is not in a high-risk zone. Do I still need flood insurance?

Flooding can occur outside mapped high-risk areas. Evaluate exposure to heavy rain, tides, and drainage, not just a zone label.

Does renters insurance cover flood damage to a tenant’s belongings?

No. Standard renters' policies exclude flood. Tenants can buy a separate contents-only flood policy for belongings.

Will mitigation really pay off?

Yes. Targeted projects reduce losses and downtime, and documented mitigation can lower premiums under property-specific pricing.

From Risk to Advantage: Win Jacksonville’s Next Storm Season

Flood costs are predictable and, with a plan, controllable. Elevate equipment, specify damage-resistant finishes, add compliant openings, tune site drainage, buy right-sized coverage, and train tenants to act early.

Keep clean records so claims, inspections, and communication stay smooth when water rises. The payoff is shorter downtime, fewer disputes, steadier premiums, and more substantial tenant confidence.

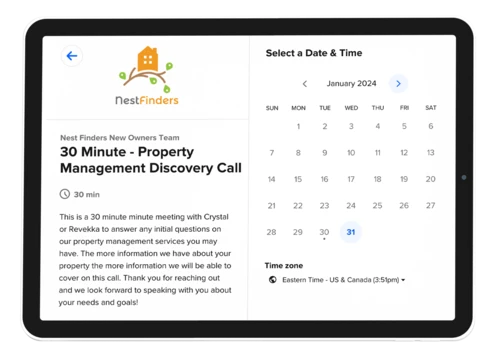

Ready to turn resilience into return? Partner with Nest Finders Property Management. We will audit each property, verify elevations and utilities, stress-test your lease and messaging, and deliver a prioritized 90-day mitigation roadmap with estimated premium impacts and vetted vendors.

Book a portfolio walkthrough today and make the next high tide a non-event!

Additional Resources

Jacksonville Code Violations That Allow Tenants to Withhold Rent

Tenant Placement in Jacksonville: How Property Managers Attract Better Renters