Tax season looks a little different for business owners. Property managers especially need to have a good understanding of tax statements and 1099s to accurately report income.

As a Jacksonville, Florida landlord, you probably didn't get into real estate for the accounting side. However, you need to know a thing or two about numbers to earn passive income and run a profitable rental business.

Learning about tax statements and 1099s is a good place to start, especially as tax day is quickly approaching. Keep reading to learn more.

Defining Tax Statements and 1099s

A W-2 is one of the most common tax forms that individuals know about. While a W-2 and 1099 form have similarities, there are important differences to discuss.

A 1099 is often used to complete rental property taxes. The purpose of the form is to report taxable income to the IRS. A landlord will submit this form as part of their landlord taxes to report non-traditional sources of income.

Small businesses, vendors, and contractors that you worked with throughout the year will receive this form.

Types of 1099s

Tax statements and 1099s are required by the IRS. If you don't report your income, you won't receive any tax deductions. You may also face a penalty and be required to pay certain fees.

Hiring a rental management company can help you collect the right forms. A property manager with accounting experience will know how and when to file rental property taxes to keep you compliant.

It's important to collect tax statements and 1099s every year for filing. Doing so helps your rental property qualify as a business. Businesses tend to get better tax deductions.

Commonly, landlords see 1099-MISC and 1099-NEC forms, although there are various types.

1099-MISC Overview

A 1099-MISC form is for documenting payments made to others within the business. You only need to file this form if you made payments totaling more than $600 in the tax year.

Generally, you'll file these forms for rental income, legal fees, and healthcare payments made to employees.

1099-NEC Overview

1099-NEC forms are reported to the IRS for payments made to contractors. For example, if you hire an independent maintenance contractor for more than $600 of work, you'll need to have this form.

You need to file this form to reap certain tax benefits. The 20% pass-through tax deduction is only available to businesses. This allows you to deduct up to 20% of your total rental income.

Take advantage of this tax deduction as it is only available through 2025.

How Can a Property Management Company Help?

It's normal for property owners to feel overwhelmed during tax season. Luckily, a property management company can help.

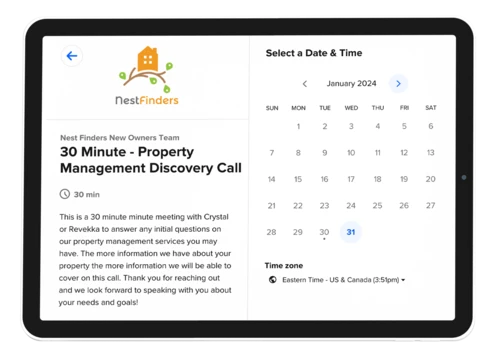

At Nest Finders Property Management, we can handle your accounting throughout the year with comprehensive financial reporting. We think about tax statements and 1099s early on so you don't have to.

Our talented team has combined decades of experience in Greater Jacksonville. In addition to accounting and tax services, our property managers can improve your investment with full-service property management.

Contact us today for a customized plan.