Jacksonville, Florida, has quickly risen to prominence as a hotspot for real estate investors seeking good cash flow and long-term passive income.

Jacksonville offers affordable purchase prices, a growing economy, and attractive tax benefits, making it a good place to maximize rental property cash flow.

But unlocking this potential requires more than just buying one property — it demands strategy, market insight, and careful attention to monthly expenses, operating costs, and your investment strategy.

Whether you’re new to real estate investing or managing a growing portfolio of investment assets, here are essential tips for maximizing your rental cash flow in Jacksonville.

1. Know Jacksonville’s Real Estate Market

The foundation of positive cash flow starts with understanding market conditions. Jacksonville’s neighborhoods offer diverse opportunities — from single-family homes in Mandarin to trendy condos in Riverside.

Research similar properties to determine competitive rental rates and assess vacancy rates. Tools like an ROI calculator help you estimate gross rental income, monthly payments, operating expenses, and ultimately, your net cash flow.

Remember to account for property taxes, insurance costs, condo fees, and other recurring expenses that affect your Net Operating Income (NOI). Diligent research ensures your real estate deals align with your financial goals.

2. Perform Thorough Tenant Screening

Your rental income depends on the quality of your tenants. Implement a solid screening process to avoid negative cash flow. Always check credit history, verify employment and monthly income, and contact previous landlords. Reliable potential tenants mean steady income and fewer risks to your property’s cash flow.

Consider charging application fees to cover screening costs and attract serious applicants. Collecting rent from trustworthy tenants on time will sustain your cash flow annually.

3. Set Competitive Rental Rates

Optimizing your monthly rent is crucial to achieving more income without pricing out tenants. Study market conditions and compare similar properties to find the sweet spot. Charging too high can increase vacancy rates, while charging too little limits your income streams.

Leverage your real estate industry resources to monitor interest rates, inflation, and local demand. Adjust your rental rates regularly to keep pace with the market and increase cash flow over time.

4. Minimize Vacancy Periods

An empty unit drains your annual cash flow. Effective marketing and tenant retention are key to maintaining more cash flow. Use high-quality photos and engaging descriptions, and list your investment property across multiple platforms.

Highlight amenities like energy-efficient appliances, updated interiors, or even pet-friendly policies. You may also charge pet fees for extra income and insurance.

Retention is just as important. Prompt maintenance and good communication build tenant loyalty, reduce turnover, and safeguard your rental property's cash flow.

5. Reduce Operating Expenses

Keeping operating costs under control directly boosts your net cash flow. Regularly audit your maintenance costs, management fees, and other expenses. Negotiate vendor contracts, implement energy-efficient solutions, and consider adding vending machines or paid parking to diversify income streams.

Accurate budgeting is also essential. Use a rental property calculator to forecast operating expenses and ensure your monthly income exceeds your monthly payments, resulting in good cash flow.

6. Leverage Tax Benefits and Depreciation

Florida’s lack of state income tax already benefits your real estate cash flow, but federal tax benefits add even more. Deduct mortgage payments interest, property taxes, insurance costs, repairs, depreciation, and even management fees.

Proper documentation of expenses maximizes deductions and clarifies your cash-on-cash return. Work with a CPA familiar with real estate investments to uncover hidden savings that can boost cash flow and reduce other expenses.

7. Implement Preventive Maintenance

Ignoring repairs can lead to higher maintenance costs and decrease your property value. Establish a preventive maintenance schedule to extend the lifespan of your real estate property.

Jacksonville’s humid climate demands extra vigilance for HVAC systems, roofing, and plumbing. A well-maintained investment property commands higher monthly rent, attracts quality tenants, and sustains your positive cash flow.

8. Hire a Professional Property Management

While managing a property yourself may seem like a way to save money, a professional property management company brings expertise that enhances your property’s cash flow. They handle collecting rent, tenant screening, maintenance coordination, and compliance with local regulations.

With fewer vacancies and better tenant experiences, you’ll see more cash flow and enjoy truly passive income from your real estate investments.

9. Explore Short-Term and Corporate Rentals

Jacksonville’s thriving business hubs and military presence create demand for short-term and corporate rentals. These can command premium rates, significantly increasing monthly income compared to traditional leases.

Before pursuing this investment strategy, check zoning laws and Homeowners Association ( HOA) regulations. Also, factor in higher operating costs and management fees for more frequent tenant turnover.

10. Continuously Educate Yourself and Reinvest

The real estate industry is dynamic. Stay informed about interest rates, cap rates, and local developments that can impact real estate cash flow. Reinvest profits from your investment property into increasing revenue through smart upgrades or acquiring more property.

Expand your portfolio cautiously, always performing due diligence to maintain a significant amount of net cash flow on each investment asset.

Proven Steps to Maintain Positive Cash Flow in Jacksonville Rentals

Jacksonville offers exciting possibilities for real estate investors who aim to generate passive income and achieve good cash flow. By understanding the market, optimizing your purchase price, and controlling operating expenses, you can unlock the full potential of your investment property.

Whether you own a downtown condo or a single-family home in the suburbs, applying these tips for maximizing your rental cash flow in Jacksonville will position you for long-term success.

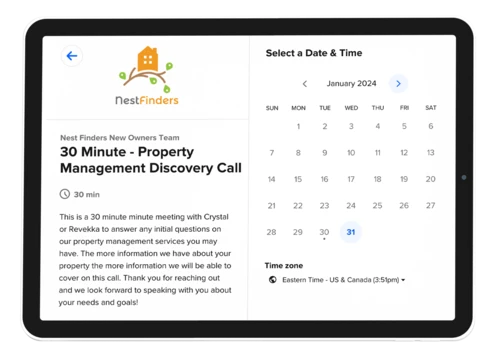

If you’re serious about increasing your rental income, reducing vacancy rates, and boosting your property’s cash flow, Nest Finders Property Management is your trusted partner.

Our expert team helps real estate investors like you optimize monthly rent, control operating costs, and turn every investment property into a cash flow success.

Don’t miss out on more income and a better cash-on-cash return. Contact Nest Finders today for a free rental property analysis and start maximizing your rental property cash flow!

Additional Resources

How to Calculate Prorated Rent: A Guide for Jacksonville Landlords

Which Up-And-Coming Jacksonville Neighborhoods Should You Be Investing in Now?