Jacksonville Rental Market Update – October 2025: Why Homes Aren’t Leasing Fast (and What Landlords Can Do)

A Message from Our Broker Blakely

Happy October! In this blog we will be looking back at Septembers leasing data.

The rental housing market is going through one of its toughest periods in recent history. By looking closely at the data, we can cut through the noise and see the real story: opportunities, risks, and the strategies landlords must adopt now to succeed. Please take time to read this and read helpful tips near the end. This is a big investment you own, you want it to perform, we want it to be successful for you and we are here to help!

This month’s insights are based exclusively on Northeast Florida MLS data, giving us the most reliable view of professionally managed rentals.

It’s important to note that many homes for rent—particularly those listed directly by owners— never appear in MLS. These properties often sit vacant longer and lack the pricing transparency of professionally marketed rentals. The trends below highlight why professional exposure and strategy matter more than ever.

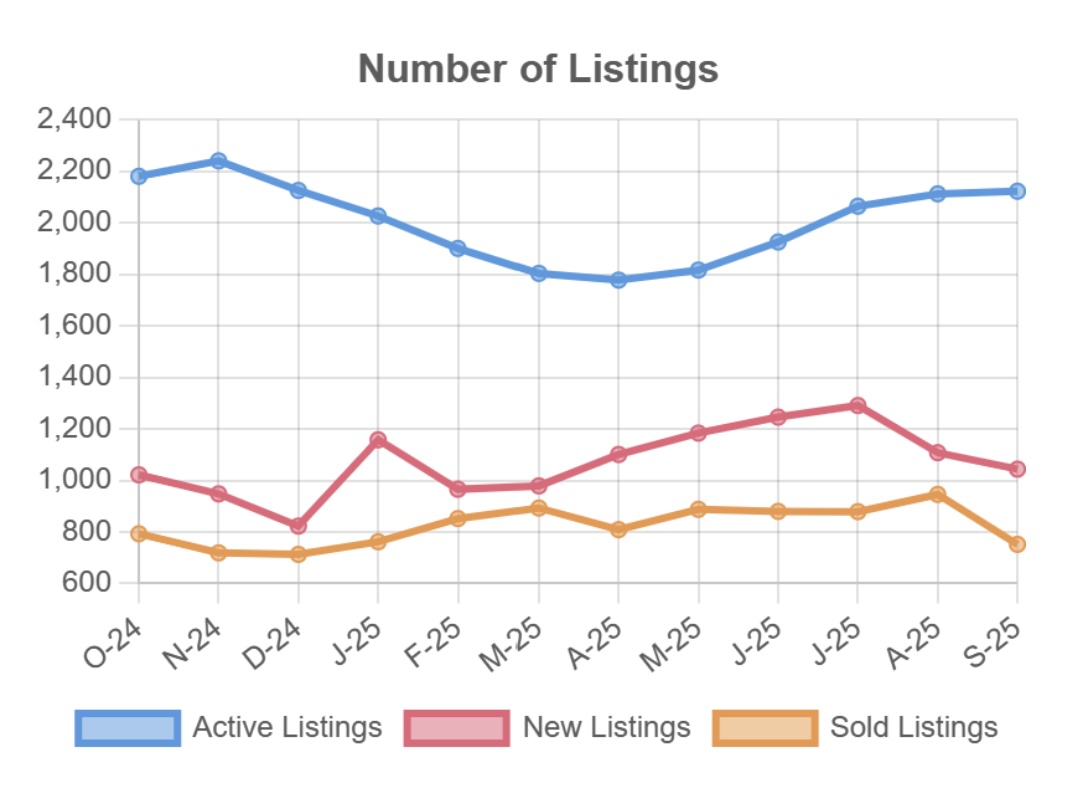

Listing Trends

- Active Listings: Following the typical seasonal cycle, supply is expected to rise through fall before tapering in spring.

- New Listings: Down 19% from July to September — a steeper decline than normal.

- Rented Homes: Fell 20% from August to September, echoing last year’s sharp seasonal slowdown.

Takeaway: The slowdown is real but largely seasonal. Historically, a small uptick is expected in October before bottoming out in winter.

Pricing Pressures

- Median Active Price: Holding steady but from a weaker summer peak than last year.

- Median Rented Price: Dropping faster than list prices, confirming tenants are signing leases below asking.

- Trend: In 2024, rents fell from $1,975 to $1,850 through winter. This year, with a peak of only $1,915, we could bottom closer to $1,775 by December or January — levels not seen since early 2022.

Takeaway: Price aggressively now, or risk chasing the market downward and enduring prolonged vacancies. You can set the comp—or wait while lower-priced homes lease ahead of you.

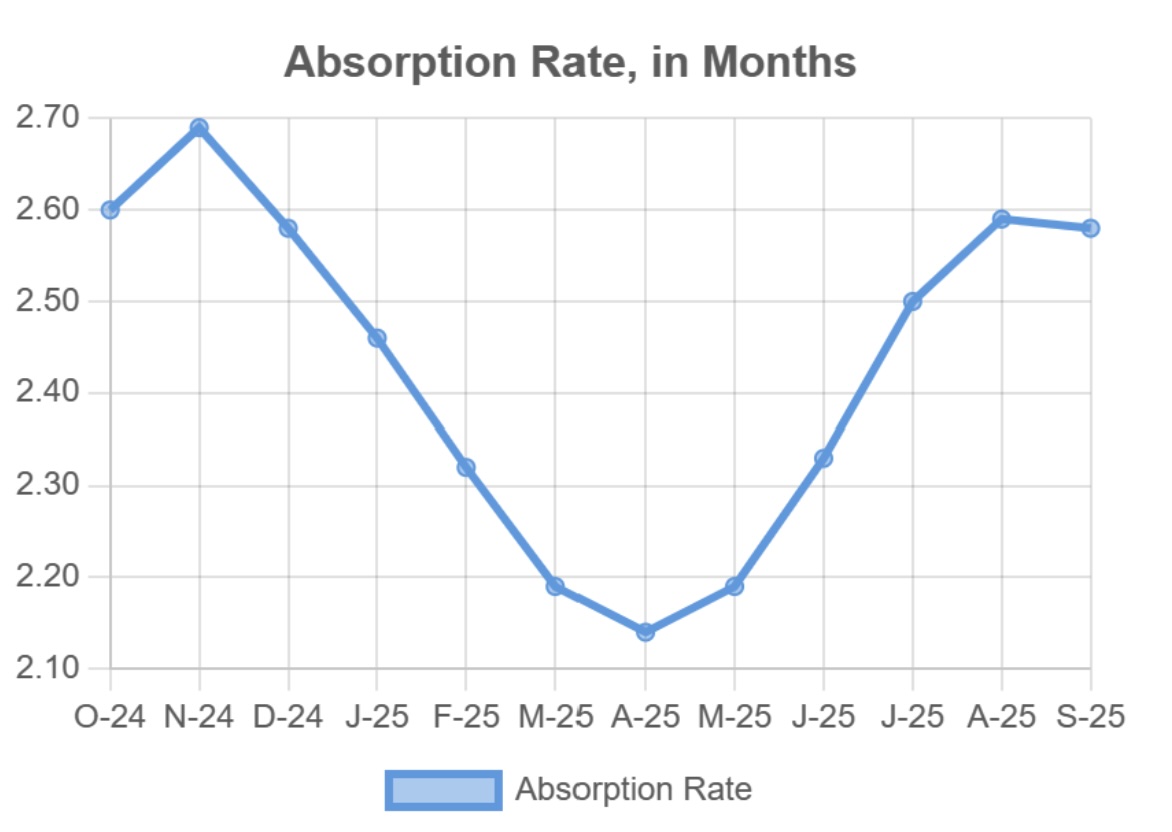

Absorption Rate

The MLS absorption rate (time needed to rent all current inventory) was 2.6 months in September. This excludes self-managed inventory and marks the first time since 2020 that the monthly rate has never dropped below two months in a calendar year.

Takeaway: The market is moving much slower than landlords are used to. Conditions likely won’t improve until January through April.

Days on Market (DOM)

- Average DOM (September): 45 days

- Peak (January): 55 days — the longest in five years

- Low (July): 42 days

Critical Note: MLS days-on-market reflects professionally managed listings. Homes listed directly by owners — which often don’t appear in MLS — typically sit vacant significantly longer. Limited marketing reach, weak pricing strategy, and inconsistent tenant screening all contribute to delays.

Takeaway: The professional edge matters. If MLS-listed homes are struggling, non-MLS rentals are performing far worse. Remember for rent by owners with no professional leasing teams, marketing, advertising, cell phone photos vs professional, are likely sitting much longer!

Summary & Outlook

- New listings down 19%

- Rented homes down 20%

- Median prices trending toward early 2022 levels

- Days on Market at a 5-year high

Strategy for Owners: Adjust pricing proactively, market aggressively, and lean on professional management to stay competitive.

Optimism Ahead: While conditions feel rough now, every slowdown is followed by recovery. Landlords who adapt today will protect cash flow and position themselves for upside when demand strengthens again.

What Owners Can Do to Move Vacancies Faster

- Lower rent incrementally every 7–10 days until activity increases.

- Offer move-in specials — e.g., one month free rent, or two months free on longer terms.

- Allow pets — pet-friendly listings get more inquiries and lease faster.

- Refresh marketing — bright, clear, updated photos matter.

- Respond quickly to all leads — ideally within hours.

- Improve curb appeal — mow lawns, pressure wash, repaint, refresh mulch, replace worn fixtures, clean carpets.

- Be flexible with lease terms

- Nest Finders is doing our part, offering app fee and admin fee specials on approved applications based on days on market, but we need you to follow our guidance, we view you as a partner, you're losing money and we aren't making management fees on empty assets. Let's work together!

Remember: Holding out for an extra $200/month on a $2000 a month home, can cost $3,000+ in vacancy loss if the home sits empty just for six weeks.

Work With the Experts

At Nest Finders, we check these boxes every week. We run price reviews, offer targeted specials (free application or move-in fees on select units), and continuously optimize marketing and screening to reduce days on market.

Contact us today to get your vacancy leased faster. www.nestfinders.com