If you intend to purchase a rental property in Jacksonville, Florida, now is the ideal time to take action! In addition to the state's strong economy, job growth and consistent population growth, Florida is a great place to purchase a rental property.

For novice real estate investors, Jacksonville, Florida, is a promising real estate market. Investing in the Jacksonville real estate market will likely be beneficial. This article will help property investors get started in investing in Jacksonville real estate!

What is the Jacksonville Real Estate Market Like

With more and more people relocating to Jacksonville for its suburban lifestyle in and less expensive housing prices in the market the Jacksonville metro area is one of the most popular areas for all kinds of renters.

Jacksonville’s population is growing faster than local authorities predicted, which means there is a stronger demand for rental units in the area. This city can offer Jacksonville real estate investors a taste of the Florida property market at a reasonable price with great home values. Its entry cost and home prices in the Jacksonville market are far less than other California markets or the national average.

As a clever real estate investor, you can profit from the increased demand for properties that results from the influx of new residents.

Tips for Purchasing a Jacksonville Rental Property

Look for Jacksonville Homes in Your Budget

Real estate investors in a Florida city should begin imagining the property they want before making a purchase. As a city, Jacksonville offers a variety of housing types, including apartment buildings, townhomes, single-family homes, and multi-unit buildings. Due to the variety of property options in real estate markets, you can invest in Jacksonville properties that best meet your needs.

Before you invest in Jacksonville, your next step is to review your spending plan and determine your price range. This way you can save time by only looking at residences in your price range. Additionally, it's crucial to take additional HOA dues and property taxes into consideration. If these fees are high, they will impact your budget and your bottom line.

Choose the Type of Property You Want

Selecting the right kind of property is the most important factor in real estate investing in Jacksonville, Florida. Do you want to rent out a condo, a townhouse, an apartment building, or a holiday rental in Jacksonville?

Not every Jcaksonville investment will suit your needs depending on your spending capacity, personal preferences, and desired returns. Be sure to conduct market research to identify the most sought-after investment properties. It’s also important to consider how current market trends will evolve over time.

Just keep in mind that while one investment might deliver significant profits in one market, like Jacksonville, it might do the exact opposite in another. Successful investments depend on picking the appropriate kind of property.

Consider the Neighborhood

A property's location is just as important as the property itself. Make sure the location you choose is one potential tenants want to call home.

You should also look at local school districts if you want to rent to families. Parents are more likely to select neighborhoods with highly rated schools. Purchasing a home close to a university or downtown Jacksonville might be a great strategy to break into a competitive rental market.

Think About Hiring a Professional Property Manager in Jacksonville

When you first start buying properties in Jacksonville, your enthusiasm may cause you to lose perspective and believe you can manage your properties independently. However, managing Jacksonville properties requires a lot of time and work. The more Jacksonville properties you own, the more work you’ll have to do. When handling maintenance and repair requests from your Jacksonville renters, you must be able to handle problems of all sizes.

Additionally, it’s important to be prepared to tackle issues head-on and offer answers to your tenants if you decide to manage your own property. Contracting a reputable property management firm can give you the peace of mind you require while reducing your workload. A good company will provide you with a wide range of services and prioritize your tenants' comfort.

Consider Capital Growth and Rental Income

Capital growth is essential because the main goal of choosing to invest in a property is to make money. Where do you invest? What is nearby? Is there room for new construction, or will demand exceed supply for investors? Your Jacksonville property’s value will depend on nearby amenities and new developments in the area.

Rental income is also critical to maximize your ROI. To guarantee a consistent income stream as investors, you need to buy a Jacksonville home that renters want to stay in long term.

Conclusion

Once you have a general idea of the kind of home you can afford, investing in a rental

property in Jacksonville will be easier! However, managing your own rental comes with a variety of responsibilities.

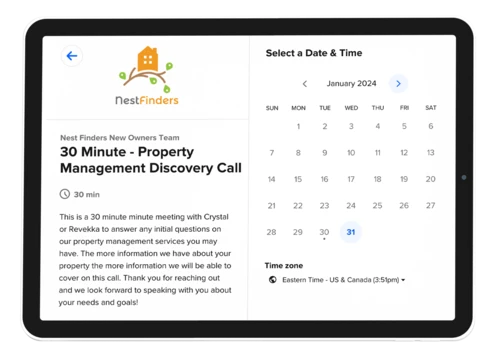

Hiring a company like Nest Finders Property Management is a great idea if you want to reduce your stress while maximizing your income! Our comprehensive services will keep you, and your Jacksonville renters, happy!