Ensuring you follow federal, state and municipal Landlord-Tenant Law is not only critical to your success as a Florida landlord but is in your best interest as it will help you avoid any financial or legal issues with your tenant.

The following are the basics of the Florida security deposit laws.

Landlord Rights

As a landlord, you have the right to require a security deposit from your Florida tenant. A tenant's security deposit helps provide a financial cushion against certain risks that come with renting out a property.

A security deposit may, for instance, come in handy in the event a tenant trashes the landlord's property and moves out without fixing the property damage. A landlord may be able to use part or all of their deposit to cover the costs for any necessary repairs.

In addition to requiring a tenant's security deposit, renting to the right tenant is key to keeping your property and ROI in great shape. After all, a security deposit can only do so much. Therefore, make sure you have a thorough tenant screening process in place before signing a lease.

Security Deposit Limits

Landlords in the state of Florida are able to charge any amount they like when asking for a security deposit from a tenant.

While a landlord can technically charge tenants whatever amount they want per Florida security deposit law, it’s always a good idea to keep the amount of the security deposit reasonable. A good guideline to follow is keeping the security deposit amount between one to two month's rent.

So, if the monthly rent rate per the lease agreement is, say, $1,300, then the landlord shouldn’t charge a tenant more than $2,600 as a security deposit. This amount should be enough to protect the landlord from potential financial losses without making their rental unit less desirable to a prospective tenant.

Security Deposit Storage

Every state has its own requirements when it comes to how landlords must store their tenant’s security deposits. In the state of Florida, landlords have three options.

The first option is to store your tenant’s security deposit in an interest bearing account. This interest bearing account must be in a financial institution located in Florida. When storing your tenant’s deposit in an interest bearing bank account, it's important to be aware of the interest rate.

A landlord must pay the tenant the interest accrued annually and once their lease has ended. The landlord can also, with their permission, pay it directly to them or credit it back in form of rent.

The second option is to store the deposit in a non interest bearing account. Just like the first option, the non interest bearing account must be in a financial institution located in Florida.

Additionally, per Florida statute, a landlord must keep the tenant’s security deposit in an account that does not contain any personal or other funds.

The third option is to post the tenant’s deposit as a surety bond. The surety bond must either be for the security deposit amount or $50,000 whichever is less. The surety company the landlord uses must be in the same county where their rental property is located. In addition to posting the surety bond, the landlord must also pay the tenant an annual interest accrued of 5%.

Security Deposit Receipts

In the state of Florida, landlords must notify their tenants in writing within 30 days of receiving the tenant’s security deposit. This initial written notice to tenants must contain the following info.

Where the landlord is storing the tenant’s security deposit.

Whether the landlord has kept the deposit in its own account or commingled with other funds, such as other tenant’s deposits.

The rate of interest that will be paid to the tenant every year.

The landlord may then deliver an initial written notice to their tenants either in person or via certified mail.

If the landlord has to move the deposit, for any reason, they must notify the tenant within 30 days of the deposit being moved.

Security Deposit Deductions

Landlords in Florida have a right to make appropriate deductions to a tenant’s security deposit in certain scenarios.

For Florida landlords, appropriate deductions from a tenant's security deposit are as follows.

To cover unpaid utilities or rent as outlined in the lease.

Other lease violations that cause you financial damage.

To repair damage exceeding normal wear and tear.

What is Normal Wear and Tear

A landlord may come across both wear and tear and property damage during a walk through inspection. When considering security deposit deductions, it's important to know the difference between damage and wear and tear.

Florida defines normal wear and tear as the deterioration that occurs on a property through normal use by the tenants. They are minor issues that a landlord may notice when they rent out their Florida unit, such as faded wall paint, loose door handles, and gently worn carpets.

Excessive property damage that warrants deductions from security deposits, on the other hand, is any destruction that occurs because of a tenant’s carelessness, negligence, misuse, or violation of the lease agreement. Examples of tenant property damage include large holes in the walls, broken or missing floor and wall tiles, torn linoleum, broken windows, or heavily stained carpet.

Returning Security Deposits

You must return the renter's deposit to your tenant within a period of 15 days after the tenant moves out of your rental if you are making no deductions.

However, if it's the landlord's intention to make any deductions, then you’ll have 30 days to provide them with written notice of the deductions from security deposits you intend to make. If you fail to provide this notice regarding the tenant's deposit, you forfeit your right to make any security deposit deductions from your tenant when you return the security deposit.

After receiving their landlord's claim through written notice, the tenant will have 15 days to dispute any charges. Per Florida's Security Deposit Law if the tenant doesn’t have any objections or the tenant fails to notify you of them during this time, you then have 30 days to send them any remaining funds from the deposit.

Change in the Property Ownership

If you sell your property, you’ll need to transfer your tenant’s already paid security deposit and any accrued interest to the new owner or incoming landlord per the state's security deposit law. You must also create a written receipt for the tenant indicating the date of transfer and the transferred amount.

Once you’ve done this, you’ll be relieved of any responsibility pertaining to holding or returning the tenant’s deposit. Please note, however, that you’re still responsible for any violations made to the security deposit’s terms prior to the change in property ownership.

Bottom Line

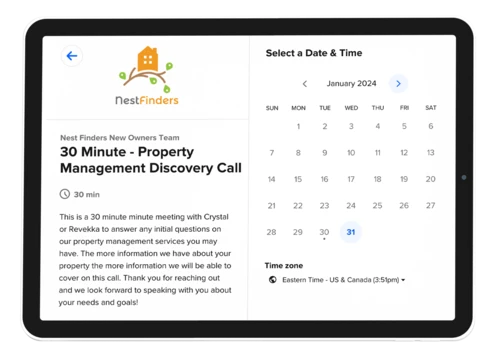

Security deposit laws in Florida can be difficult to keep up with as a busy landlord! If you have any questions regarding Florida Landlord Tenant Laws, Florida's Security Deposit Law or any other aspect of property management, Nest Finders Property Management can help!

Nest Finders Property Management is a property management company dedicated to providing Jacksonville property owners with transparent property management services. Get in touch with us to see how we’ll save you time and money!

Disclaimer: This blog is not a substitute for professional legal advice from a qualified attorney. Also, laws may change and this content may not be updated at the time you read it.