The most recent census data shows that Jacksonville is one of the fastest-growing cities in the country. That is a good thing for investors and property owners, but it also means increased competition.

For this reason, landlords must put their best foot forward while protecting their real estate interests. Security deposits are one effective mechanism for doing so.

This article provides four essential security deposit tips for Jacksonville landlords. Keep reading to find out how to protect your financial interests while getting the most out of your property.

1. Understand Security Deposit Laws

The first rule of security deposits is to understand state and federal housing law requirements. Florida does not limit how much a landlord can charge for a security deposit, but there are other regulations. For instance, a property owner must return a security deposit within 15 days of a tenant's departure.

There are specific circumstances that a landlord can deduct from the deposit. These include failure to pay rent and significant damage to the property. Understanding these parameters is vital for operating within the confines of the law.

2. Conduct Regular Inspections

Security deposits can compensate landlords for tenants who fail to pay rent. They can also cover expenses to repair damage to the property. For this reason, landlords should conduct regular inspections.

An initial walkthrough before occupancy is important. This ensures the property owner and tenant agree on the state of the property. An inspection before move-out is also necessary.

Beyond these, you should do inspections every three to six months. This allows you to spot even minor issues before they become major ones. Specify the frequency of inspections in the lease.

3. Maintain a Separate Security Deposit Account

This is especially important if you operate multiple rental units. Keeping security deposits in a separate bank account will make accounting easier.

It helps you avoid the temptation to spend it on other items, such as property repairs or upgrades. Keeping the funds in an interest-bearing account also lets you earn money in the interim.

Most importantly, it also makes the money accessible to you. This is important if a tenant moves out unexpectedly (without violating the lease).

4. Be Reasonable About Deductions

A final tip regarding security deposits is to be reasonable about deductions. It is completely reasonable to compensate yourself for serious damage to the property, but pushing things too far could leave a bad taste in a vacating tenant's mouth. This could result in negative reviews of you as a landlord, which could cost you more in the long run.

Consider normal wear and tear as part of the cost of doing business. Cleaning carpets or repainting walls is a nominal cost compared to the gains you will see by having a reputation as a good and fair landlord.

Learn More About Managing Security Deposits

Now that you have some tips for handling security deposits, you can make the right decisions based on your financial needs and rental goals. An experienced property management company can further advise you on how to get the most out of security deposits.

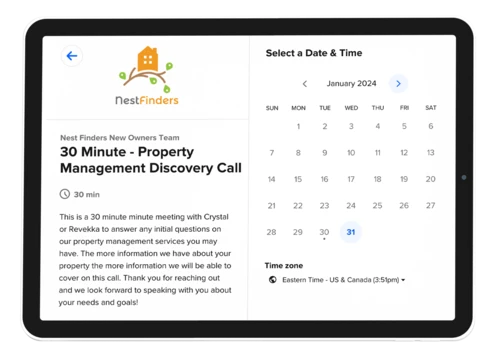

Nest Finders provides unmatched real estate management expertise for Jacksonville, St. Augustine, and the surrounding areas. We offer a range of services, including marketing, tenant placement, rent collection, and more. Reach out to us today to learn more.