Going into 2021 you may be questioning everything, including your investments. We have been through a lot this year between the recent election and the Pandemic. It may be time to take a look with fresh eyes at your investment portfolio, including your real estate investments.

Real Estate isn’t just about rent.

Yes, you are getting paid rent each month from your rental property, but that is only part of the strategy. Hopefully, you are in a good position where your renters are paying not only the mortgage but enough to put away for future repairs or pay down the principle of your loan.

There is more than just a yearly profit to be made from a rental property. If you are in this for the long term investment your property has more to give.

They say cash is king and if that is true then cashflow is queen. Knowing you have income coming in month after month can be very reassuring in these uncertain times.

Tax advantages

According to Investopedia, “Real estate investors can take advantage of numerous tax breaks and deductions that can save money at tax time. In general, you can deduct the reasonable costs of owning, operating, and managing a property.”

If you have rental property and have not sat down with your CPA to find out where you could maximize your potential tax savings you are doing yourself and your investment a disservice.

Because this is an investment you can potentially write off your repairs, upgrades, and property management fees while your asset appreciates. With a quality property manager like Nest Finders, you will get monthly reports showing what costs you have and the income generated.

They work hard to keep the paperwork simple for you. All you have to do is deliver it with your other tax documents at the end of the year.

Appreciation of land and house value

The value of the house is not the only number that should concern you when you are looking at a real estate investment. Yes, the property value will go up, but so can your rent.

As other costs of living increase so do rent prices. You could expect to increase the amount of rent you charge every couple of years at a minimum. If you have a good tenant you may want to sit tight with your current price, but when they move out it is the perfect opportunity to increase the rent to the current market value.

This increase in rent will give you more monthly cash flow and the possibility of more freedom to invest in yourself by expanding your portfolio.

Mark Twain is attributed to saying, “Buy land. They’re not making it anymore.” This could not be a more true statement.

According to Forbes, “Wise investors don’t bet on appreciation. They purchase properties on a sound judgment that the property will generate more income than it costs to own. For these folks, who “cash flow” positively, they don’t care what the market does. If prices drop, they are safe. If prices rise, they have more options.”

“I don't like the term property manager anymore because it demeans the profession. We are an asset management company. So that home is no different than an IRA or any other type of, you know, retirement tool. Like it's an income producing property. It needs to be well-maintained.”

- Blakely Hughes, Owner Nest Finders -

“Forced equity is a term used to refer to the wealth that is created when an investor does work to a property to make it worth more. Unlike appreciation, where you are at the mercy of the market and factors you cannot control, forced equity allows investors an option where they can have a hand in increasing their properties value.

Many investors force equity by adding features like extra bedrooms, bathrooms or square footage. The key is to look for properties with less than the ideal number of amenities, and then add what they are lacking to create the most value.” say Forbes insiders.

It may not be time to add another property, but you may have one that could benefit from an addition that will yield more rent profit each month.

Leveraged value can allow you to invest even more.

According to renowned financial advisor Dave Ramsey, “the key to buying real estate that appreciates is location.”

Knowing your market can make or break your real estate investment. Having someone on your side who knows the market like Nest Finders can help you make the right decision.

Unless you are a realtor yourself it can be hard to navigate where the best investment can be made. Using the knowledge of a pro can help you protect yourself.

Mercer.com says, “Real estate has repeatedly proved itself as a valuable component of an institutional investor portfolio. Over the long term, US core real estate has generated higher returns than fixed income and lower volatility than equities while consistently providing diversification benefits to both asset classes.”

We may not be out of the woods yet with the Pandemic, but a quality rental in the right neighborhood may help you feel more secure with the future.

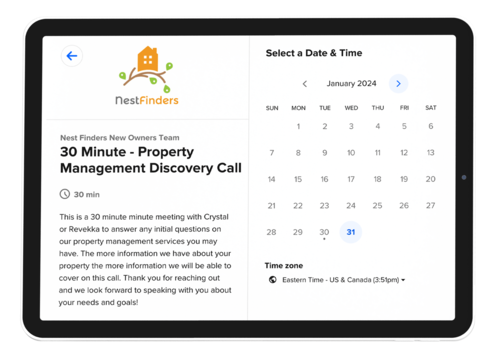

Now is the time to go over your investment options and see if a rental property, or another one, is a sound investment for you in 2021. Let the professional team at Nest Finders help you protect your assets with boutique quality service.