Rental Market Trends: March 2024 Data

Message from Our Broker

April is here and Spring is in the air, and we have just wrapped up Q1 of 2024! The MLS has just released the March 2024 data, so let's take a look! Overall, the rental market is showing strong signs of improvement and coming out of our normal winter slowdown. We saw a continued decline in new listings, which helped our absorption rate dramatically, and with that, we are seeing listing prices increase. Nest Finders Property Management keeps its finger on the local data. Below we have it broken down in 4 easy to digest data points, we hope this helps!

Active Listings:

For the fourth consecutive month, we have seen a decrease in the monthly active listings on the market. In fact, March was a 12-month low of active rental listings with 1,475 active listings. This is a result of 4 consecutive months of sub 1000 new listings being added to the market and our sold listings, or rented homes, holding steady at 800.

This graph above in blue, illustrates the trend in active listings over the past few months, clearly showing the decrease.

This graph above in blue, illustrates the trend in active listings over the past few months, clearly showing the decrease.

What the above graph does not show, is that we likely had 100-200 listings expire and come off the market without a sale, which is a normal cycle to see in any market. Overall the Active Listings are down, which is helping landlords fill vacancies and hopefully continue to strengthen the rental prices.

Listing Price:

The Active Median List Price is currently sitting at $2,000/month, which is a 12-month high for our market. The Median List Price for new inventory is just slightly lower at $1,950. However, the Sold (or rented) Median Sales Price came in at $1,890. As we will see shortly, the data does seem to indicate that the market prices are contributing to the homes sitting on the market longer than we want to see.

As indicated in this graph above in green, the data seems to suggest that the market prices are contributing to homes sitting on the market longer than desired.

Days On the Market (DOM):

In our opinion, DOM is one of the most important factors for landlords and investors to consider when budgeting and planning. This is one of if not your biggest expenses, vacancy. Currently, the North Florida Market is sitting at 49.2 Average Closed Days on the Market.

We have not seen 4 consecutive months over 49 days since prior to 2020. A healthy figure to look for is a DOM to be between 30 and 40. In March of 2023, our Avg Closed DOM was 45 Days, also a record at the time. So we are unfortunately almost 9% higher this year than the same period last year. This can be hindered by many factors, including seasonal demand, but a high asking price for rental is often a contributing factor. We are seeing many landlords and investors ask for higher rents due to increases in property expenses, however, that increase may be contributing to higher vacancy periods and lower net revenue.

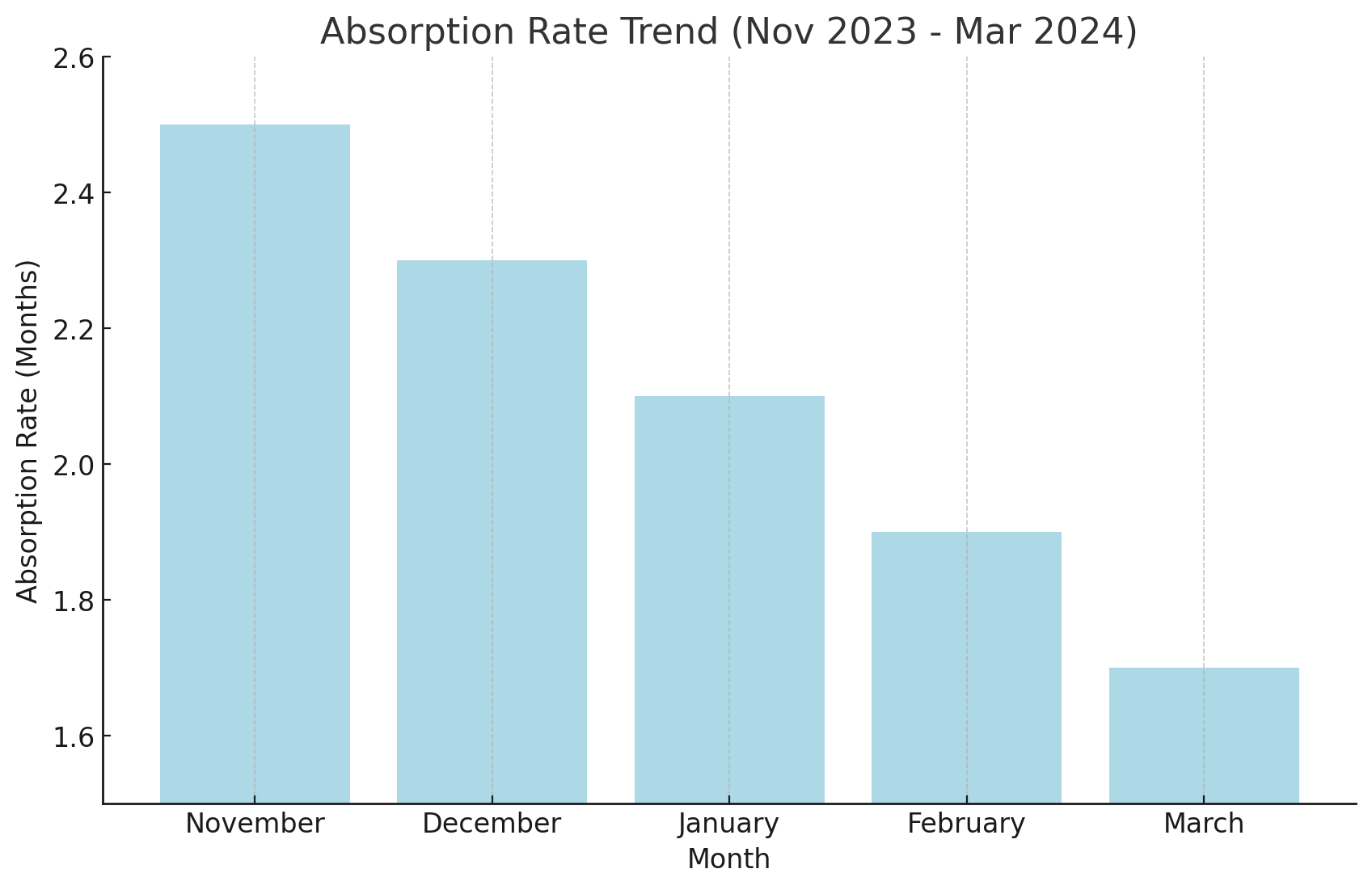

Absorption Rate, In Months:

The Market has seen a sharp decline in Absorption Rate. The Absorption Rate is basically a measure of how many months of rental inventory is available if no other properties were listed on the market. The North Florida Market has seen 4 consecutive months with a decline. Declining from a peak of 2.5 months in November to our 12-month low of 1.7 Months today. This is another indicator that inventory is shrinking and effectively the demand is outpacing the supply. We have seen almost a 20% decrease from this same time last year.

Declining from a peak of 2.5 months in November to our 12-month low of 1.7 Months today. This is another indicator that inventory is shrinking and effectively the demand is outpacing the supply. We have seen almost a 20% decrease from this same time last year.

Summary:

We are seeing positive signs with inventory coming down that is helping reduce our Absorption rate. Prices are coming back up from our low in October and November of 2023, however, the Days on the Market are still very high and of great concern. As we move into the spring and summer real estate market, we will expect to see large increases in inventory; if the demand does not match the inventory, we likely will continue to see high vacancy rates until rental prices come down.

This data is from the North Florida realMLS, we Thank Aaron from our data reasearch team for compiling this, and Nest Finders hopes this helps all fellow landlords make better-informed decisions for their rental homes and investments.

Thank you!

Nest Finders