Imagine this: You're sitting in your office, surrounded by stacks of paperwork and a laptop glowing with spreadsheets. Outside, the weather is beautiful, and you can almost smell the crisp scent of freshly cut grass. But instead of heading out to enjoy the day, you're knee-deep in rental property accounting records.

As you sift through receipts, invoices, and bank statements, you can't help but wonder if there's a better way to handle all this financial juggling. How can you keep track of rental income, expenses, and taxes without feeling like you're drowning in numbers?

Luckily, we're here to help. Let's go through our top tips when it comes to rental property accounting records.

1. Track Income and Expenses

Tracking income and expenses effectively is super important for managing rental properties efficiently.

Record all sources of rental income, including base rent, late fees, pet fees, parking fees, and any other income related to the property. Ensure that you document each payment with the tenant's name, date, and amount received.

Know where your security deposits are, and who they belong to.

Distinguish between operating expenses and capital expenses. Operating expenses are usually deductible in the current tax year, while capital expenses are typically depreciated over time.

2. Keep All the Paperwork

Establish a structured filing system both physically and digitally. Use categories such as income, expenses, leases, contracts, property documents, tax records, and correspondence to organize your paperwork.

Maintain organized records for each tenant, including lease agreements, rental applications, security deposit receipts, correspondence, and communication logs. Having these documents handy can be invaluable for resolving disputes or legal matters.

Periodically review your paperwork to identify outdated or redundant documents that can be safely discarded. Purge unnecessary paperwork to streamline your filing system and maintain its efficiency.

3. Hire Property Managers

Property managers are often experienced in managing rental properties and are knowledgeable about property accounting practices. They understand tax regulations, depreciation rules, and expense categorization, which can ensure accurate and compliant accounting records.

Property managers track maintenance and repair activities. These include work orders, invoices, warranties, and inspections. This information is vital for budgeting, forecasting, and assessing the overall condition of your properties.

4. Don't Forget Landlord Taxes

In any financial venture, it's important not to neglect your taxes. Familiarize yourself with the tax deductions available for rental properties.

Common deductions include mortgage interest, property taxes, insurance premiums, repairs, maintenance, utilities, property management fees, advertising, legal fees, depreciation, and travel expenses related to property management.

If you expect to owe a lot of money in different taxes from your rental income, consider making quarterly estimated tax payments to get around any underpayment penalties. Consult with a tax advisor to determine the appropriate estimated tax amounts.

Use These Rental Property Accounting Record Tips Today

Now that you have these rental property accounting record tips, your next financial quarter is sure to go by smoothly.

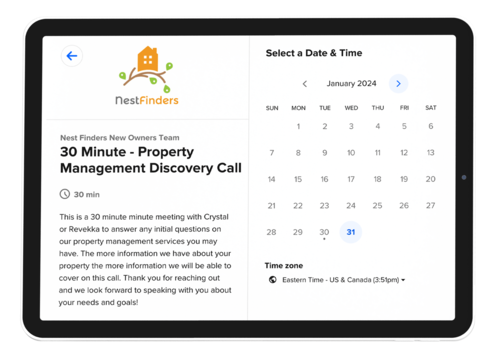

Are you looking to hire property management support in Jacksonville? For nearly 20 years, Nest Finders has been proactive in ensuring that Florida landlords like you are on the path to success. Contact us today.