Message from Our Broker!

Exciting news – the initial 2024 rental market data from North East Florida MLS is now available! This covers rental homes in Jacksonville and St Augustine. Last year was a period of adjustment for many landlords and investors. We've grown used to seeing high rental rates, low vacancy periods, and brief market durations. However, in 2023, the market experienced more variability, and early 2024 data suggests this trend might continue. Fortunately, rental prices are currently stable, with no significant decrease, despite an increase in vacancies and Days on the Market (DOM). Let’s dive into the North Florida MLS Rental Listing Data for January 2024!

Active Listings: In January 2024, the North Florida market registered about 1,744 active rental listings, a 4.5% increase from the same time last year. This marks a decrease for the second consecutive month since the November peak, a pattern usually seen in standard markets. During the holiday season, real estate activity slows, prompting landlords and managers to avoid vacancies. New listings rose from 776 in December to 1,028 in January, a typical trend. It's also important to note the slight rise in “sold listings” from December, a metric influencing DOM.

Listing Price: The median active listing price has been climbing for four consecutive months. January's median price rose from $1,900 to $1,950, up from $1,850 in October. This $100/month increase is significant over such a short period, likely a result of landlords setting lower initial prices in November and December due to expected high vacancy rates, and now readjusting to more typical rates.

DOM: A critical metric for property managers and landlords, DOM has unfortunately been increasing. January's average DOM reached 49 days, a figure not seen for years and up from 48 in December. Last year's peak was 42 days, and if trends follow, we might not see a significant decrease until April’s data.

Two Year Historical Data (below)

Sold To List Ratio: For the first time since last March, we've seen a two-month increase in the Sold To List Price Ratio, though it's still just below 96% of the original asking price. This metric reflects the necessary price adjustments to secure rentals. Historically, figures didn't fall below 98%, but recent data indicates starting prices may be about 5% too high. With prolonged DOM, a further drop in this ratio is expected by March.

Summary: As we move past the slower holiday season, the market appears to be stabilizing into a new norm. The period between February and May should provide a clearer insight into the summer market. Typically, demand and new listings increase from now until September, peaking around July/August, with DOM decreasing during this period. Many landlords and managers aim to avoid vacancies in the slower fall and winter months. Regarding renewals, I advocate for high renewal rates to maintain occupancy, even if it means stable or reduced rents.

This information, sourced from North Florida realMLS, is intended to aid fellow landlords in making well-informed decisions for their rental properties and investments.

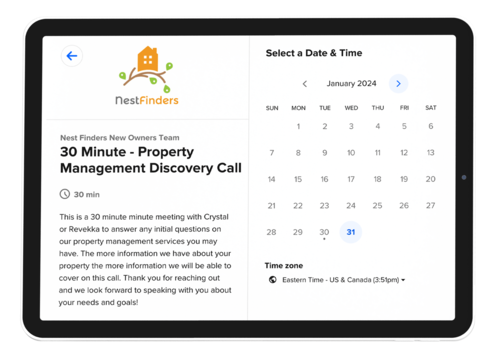

If you are in need of Property Management Excellence Please reach out to Nest Finders and schedule a call www.nestfinders.com

.jpg)