Home warranties are all the rage as a perk in buying and selling homes. There are companies out there that will sell you a policy on an existing home or new build to cover specific repairs or replacements that would be outside of your homeowner's insurance.

At first glance, it might seem like a good idea to have these appliances covered just in case, especially if you are buying a home that is several years old. In this article, we will break down what a home warranty is and why we think it is not a good choice for your rental properties (or any property).

What is a Home Warranty?

A home warranty is a contract between a homeowner and a home warranty company that provides discounted repair and/or replacement service on things like your furnace, air conditioning, plumbing, and electrical systems. Some even cover major appliances like your refrigerator.

The cost of a home warranty on average is $300-600. They can be much higher if you choose an advanced plan that covers the washer and drier, sprinkler system, a pool or even a septic system.

What it is NOT!

A home warranty is not part of or a replacement for homeowner's insurance. It will not cover you if your home is hit by hail or lightning. It will not cover you after a break-in for lost property or damage to the home. If your kid throws a ball in the house and breaks the TV, you are on your own for that replacement.

Home warranties are not insurance policies. They are a service contract. You are paying for a company to come out and repair the damage as cheaply as possible and if it cannot be repaired then they are supposed to replace that item.

According to Bankrate.com, “If you’re buying a previously owned home, you might consider getting a home warranty from a reputable company, especially if your home inspection reveals that several of the home’s appliances and systems are nearing their life span. Make sure you understand the terms and conditions of the home warranty, how long the coverage lasts and what it will and will not cover.”

You may have other coverages!

Something to consider when looking at a home you are buying is the manufacturer’s warranty already on the items in the home. If it is a new home, all of the appliances, furnace, air conditioner, and fixtures are new and likely under warranty.

You may have more coverage than you think if you used your credit card to purchase some of your appliances. Some credit card companies have an automatic extension of the manufacturer’s warranty like American Express.

Also, most states require the builder to cover repairs for 2-10 years on new construction. This gives you peace of mind and makes paying for a home warranty a waste of money.

Who is doing the repair work?

The home warranty companies use private contractors who have agreed to charge a set price saving them money. The price they have agreed to is often less than the repair would cost if you called a plumber directly. The contractors are hoping to be able to upsell you or find additional problems to make up the difference in the cost of the service.

It may be a day or two before you can get that company out to look at the item needing repair. You may have to take time off of work to meet with that contractor. Don’t forget the service fee! You will pay one on each visit ranging from $50-125 for each claim.

Make sure you have all of your documentation for any maintenance you have done to the appliance to help avoid the company telling you it not covered because of faulty maintenance.

USNews.com suggests this, “If you file a claim, get the name and contact information of the service person who comes to your home. Try to stay in the middle of the process so the warranty company can’t claim delays are caused by the contractor’s failure to send paperwork. Make copies of everything you receive and send them yourself via email, if necessary.”

Some home warranty companies will blame the inspector and tell you it should have been picked up on before you purchased the home. Others will void your warranty because there was a previous repair so they will consider it a preexisting condition and not covered.

A better than average home inspection company will include line times about what IS working in the home when it was inspected. That will remove doubt about the condition of the appliance when the warranty claim is filed.

Know your limits! Just because your repair is covered does not mean that your extended warranty might have a cap on repairs. If the cap is $2000 and you have multiple issues you might run out of coverage before all of the repairs are done.

Home warranties don’t make financial sense.

Dollar for dollar your money is probably safer in savings than with a warranty company.

According to Dave Ramsey you should never buy a home warranty, “Never buy them. Don’t buy home warranties. Don’t buy extended warranties. Don’t buy any of those kinds of things. The reason is very simple. About 85% of the home warranty amount is absolutely profit and commission to the people. It is unbelievable—the vast majority. About 12% of the extended warranty or the home warranty or the electronics warranty is actually the risk that you’re taking.”

You can’t go into a big box store and purchase almost anything and not get offered a warranty. The financing and the warranty make up a huge part of a store’s margin.

If the home warranty was not profitable for the company selling it they would not be able to stay in business. If you feel like you need to buy one consider putting that money aside in a savings account for that possibility. If you need to use that money you’ll have it. If your item does not break you have more money in your emergency fund for something else.

What should you do instead?

Consider self-insuring your home (just set the money aside in preparation for the inevitable). If you put money aside rather than purchasing the home warranty you can come out ahead of the game. You may not need the repair. You will likely pay less for a repair in the long run than the warranty will cost you.

Many trusted experts do not recommend warranties, “A possible alternative to buying one of these plans is to self-insure. Consumer Reports has long recommended that consumers put the money they would otherwise spend on a home warranty or a service contract into a savings account dedicated to product repair and replacement. Or you could stash additional money for those costs in your general emergency fund. Either way, you won't risk paying for a plan that may not provide the coverage you expect.”

If you really think you need a warranty then consider looking them up on the BBB website before you purchase. There tend to be more negative than positive reviews when it comes to home warranty companies. This will at least make sure you have all of the information about the company you will be working with.

Make sure you read the entire contract and focus on the exclusions. What are exclusions? These are the things they openly state in the contract are not included.

Your refrigerator may be covered, but the ice maker and the door seals may not be. You are probably not going to throw out the refrigerator if the ice maker does not work, but I will tell you from experience, it can be very costly to replace one.

If your seller is offering to pay for your home warranty you can take it and hope you do not use it or ask the seller to give you the cash so you could put it in your savings instead.

Angie’s List suggests you look for the fine print. What is the deductible, who decides if repair or replacement makes more sense, will you be offered the option to pay a little more to replace the unit rather than a repair that will not last? Ask a lot of questions!

Now that you know...

Once you weigh all of your options I think you will agree that home warranties do not make sense. If you have all of the information on when your appliances were installed in the home you can compare the age of each to the average life expectancy for those items. This will give you a good idea of how long it will be before you can expect to replace each appliance. You can find a comprehensive list at the National Association of Certified Home Inspectors website.

Knowing the lifespan of your systems and appliances can help you budget ahead of time for the day when you will inevitably have to replace them. Whether you live in the home or rent it out someday that refrigerator will need to be replaced. Saving money ahead of time can ease the burden of the cost when it arises.

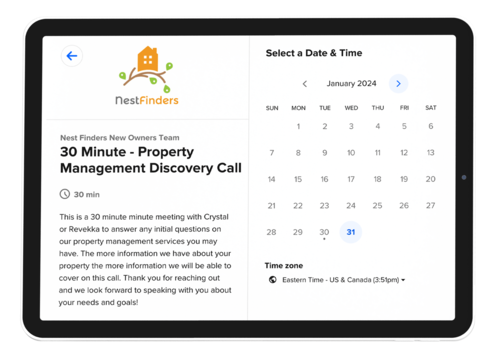

One more thing to consider is your property manager. If you have a good one like Nest Finders they will be the ones taking your middle of the night calls from the renters. They can dispatch someone right away to your home and get the repairs done ASAP. Having a savings account and a team working for you is a sound investment.