2020 may go down in the history books as one of the worst years ever, but it may be a great year for real estate investment. Could you boost your rental portfolio this year by picking up some bank foreclosed properties?

There are some good things that will come out of this year and the end of the foreclosure moratorium. If you are a real estate investor or are looking for your first property this could be a good year for you.

This will not be as catastrophic as 2008 but there will still be quite a few foreclosures. At the time of publishing 1 in every 7723 homes in Florida are already in foreclosure. Nationwide, that is actually a relatively small number.

Florida has some of the lowest foreclosure rates in the U.S. Regardless of of the low number there will still be plenty of opportunities to pick up some bank-owned properties.

We are facing unprecedented times post-pandemic and things will definitely change. “We aren’t thinking the housing market today is going to suffer anywhere near the catastrophe that it suffered during the Great Recession,” says Ralph McLaughlin, chief economist at Haus, a financial technology company.

So why are these foreclosures a better deal than just buying something off the open market? It is simple...the bank wants to get rid of the property as quickly and efficiently as possible.

“You buy foreclosures from banks and they usually want the deal done as fast as possible so they can recover the debt the borrower owes them. This means a clean process for you and taking possession of the property quickly. If you are building a rental property portfolio, we recommend investing in foreclosures because it can be faster and cheaper than buying a regular investment property.” according to Mashvisor.com

If you can score a new rental for 15-20% below market value by purchasing from the bank you are already ahead in equity. This could be a great investment over time.

That kind of savings would allow you to possibly make upgrades and hire a great team to take care of your new investment.

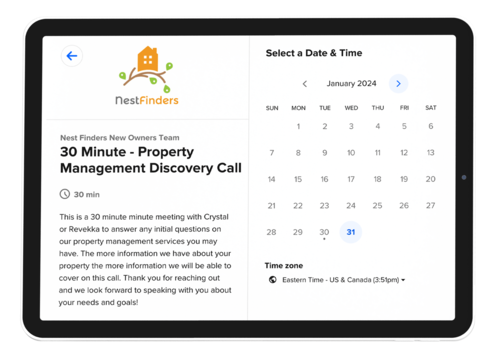

Nest Finders cares for every investor the same whether it is your first rental or your 20th. Let us take a look at how we can protect your investment and save you money in the future when you are ready to sell.